Have you ever wondered,

I want to use bybit, but are the fees cheap?

What is the leverage of bybit and the difference from BitMEX!

Bybitis a new overseas exchange started in 2018.

Although there are few types of currencies, the transaction volume has been rapidly increasing since the service started, because it allows high leverage of up to 100 times.

It is also known that there are many similarities with BitMEX, such as fees, leverage, and ease of use.

Therefore this time, we are going to introduce bybit fees and leverage.

It also summarizes basic bybit information, that enables you to trade bybit wisely byreading this article!

- Bybit deposit fee is free

- There are four types of fees required by bybit:transaction fees, financing, conversion fees, and settlement fees.

- Limit orders have a negative commission, so you can receive a commission

- Funding rate is swap fee

- Please note that bybit charges a swap fee every 8 hours.

Bybit fee list

Bybit has the following four types of fees.

| bybit fees | |

Deposit fee | ー |

Transaction fees | ◯ |

Withdrawal fee | ー |

Funding fee | ◯ |

Conversion fee | ◯ |

Settlement fee | ◯ * Futures contract only |

All of them are cheaper than other exchanges, but be careful as you may lose money if you trade without thinking

Also, some fees are free, so let’s look at each fee one by one.

feebybit deposit

The deposit fee is charged when you deposit to bybit.

Bybit doesn’t chauge deposit fee yo, so you can feel free to deposit as many times as you like.

Bybit transaction fees

A transaction fee will be charged when you trade virtual currencies with bybit.

There are only two types of bybit transaction fees, taker and maker, and the fees are the same forall currency pairs.

| Currepair | Make fee | Taker fee |

| BTC/USD | -0.025% | 0.075% |

| ETH/USD | -0.025% | 0.075% |

| XRP/USD | -0.025% | 0.075% |

| EOS/USD | -0.025% | 0.075% |

| Currepair | Make fee | Taker fee |

| BTC/USDT | -0.025 | 0.075% |

| ETH/USDT | -0.025 | 0.075% |

| BCH/USDT | -0.025 | 0.075% |

| LINK/USDT | -0.025 | 0.075% |

| LTC/USDT | -0.025 | 0.075% |

| XTZ/USDT | -0.025 | 0.075% |

| ADA/USDT | -0.025 | 0.075% |

| DOT/USDT | -0.025 | 0.075% |

| UNI/USDT | -0.025 | 0.075% |

| XEM/USDT | -0.025 | 0.075% |

| XRP/USDT | -0.025 | 0.075% |

| SUSHI/USDT | -0.025 | 0.075% |

| AAVE/USDT | -0.025 | 0.075% |

| DOGE/USDT | -0.025 | 0.075% |

| Currepair | Make fee | Taker fee |

| BTC/USD | -0.025% | 0.075% |

| ETH/USD | -0.025% | 0.075% |

Taker means market order, maker means limit order, and maker order has a negative commission.

This means that when you place a limit order, you receive a commission.

Let’s compare Mr. A, who bought 10,000 BTC / USD in a market order, with Mr. B, who sold 10,000 BTC / USD in a limit order.

If the revocation price is 8,000 USD …

In this way, Mr. A who placed a market order is charged a commission of 0.0009375 BTC, while Mr. B who placed a limit order can receive 0.0003125 BTC.

The calculation formula is applied for the transaction fee.

Transaction fee = Order price x Transaction fee rate

Order price = quantity ÷ execution price

In addition, the transaction fee for physical transactions is as follows.

| Currepair | Make fee | Taker fee |

| BTC/USDT | 0% | 0.1% |

| ETH/USDT | 0% | 0.1% |

| XRP/USDT | 0% | 0.1% |

| EOS/USDT | 0% | 0.1% |

Bybit withdrawal fee

The withdrawal fee is charged when withdrawing or withdrawing funds from your bybit account.

However, it is free to withdraw bybit, so you can withdraw as much as possible, whenever you want.

Bybit Funding Fee

Funding fees are generally referred to as financing fees.

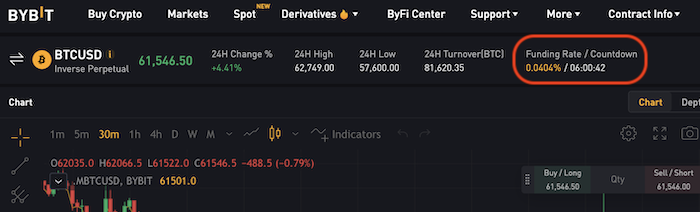

Bybit works as direct exchange between sellers and buyers, with funding every 8 hours 16:00UTC、00:00UTC、and 08:00UTC.

If you hold a position at this point, you are required to pay or receive funding.

And it is a little bit complicated to calculate this funding rate.

Bybit’s funding rate is calculated with the “interest rate”and “premium index”per minute first, and then is calculated with an 8-hour time-weighted average price on a series of minute rates.

Next, the funding rate is calculated with the 8-hour interest rate component and the 8-hour premium index.

Financing fee = Position value x Financing rate

Position price = contract quantity ÷ mark price

Real-time funding rates are displayed on the transaction screen, so you can check it if you are not sure.

Bybit conversion fee

You need to prepare the currency you want to trade as margin on bybit.

For example, if you want to trade on XRPUSD, you must have XRP as margin.

However, even if you say “there is only BTC in your wallet …”, you can easily prepare XRP by using the bybit exchange function.

The following 5 types of currencies can be exchanged.

And, the conversion fee is charged at the time of this exchange.

The conversion fee is a fixed rate of 0.1% for each request, but it can be cheap considering the time of depositing and withdrawing, and the fee for remittance.

The limit of the exchange amount depends on the currency.

| Currency | Currency minimum | Maximum limit Onece | Maximum limit 24hour | Maximum limit entire exchange |

| BTC | 0.001 | 200 | 200 | 4,000 |

| ETH | 0.01 | 2,000 | 2,000 | 40,000 |

| EOS | 2 | 100,000 | 100,000 | 2,000,000 |

| XRP | 20 | 3,000,000 | 3,000,000 | 60,000,000 |

| USDT | 1 | 3,000,000 | 3,000,000 | 60,000,000 |

Bybit settlement fee

Bybit charges a settlement fee when you close a position.

However, there is no settlement fee for futures contracts only, and if you settle by the due date, they don’t charge you any fee.

If you do not settle by the due date in the futures trading, 0.05% is collected as a settlement fee.

What is bybit as an exchange?

A lot of people may wonder what bybit is, because it is an exchange that has just started.

We are going to introduce the outline of bybit and the basic service contents below.

Basic information

Bybit is a new overseas exchange started in 2018.

It is also known that there are many similarities with bitMEX, such as 100 times leverage at maximum and the negative fee.

| Operating company | Bybit Fintech Limited |

| Established location | 2018,3 |

| CEO | Singapore |

| Official account | Ben Zhou |

Currencies and leverage

Bybit handles 20 currencies, which is a little small, and there are two types of transactions, dollar- denominated and tether-denominated.

It is not common for overseas exchanges, but there is no problem for trading in mainstream currencies.

Also, leverage is available up to 100x only for BTC pairs, and up to 10-50x for other currencies.

| Currepair | Maximum Leverage |

| BTC/USD | 100x |

| ETH/USD | 50x |

| XRP/USD | 50x |

| EOS/USD | 50x |

| Currepair | Maximum Leverage |

| BTCUSDT | 100x |

| ETHUSDT | 50x |

| BNBUSDT | 50x |

| ADAUSDT | 25x |

| DOGEUSDT | 25x |

| XRPUSDT | 50x |

| DOTUSDT | 25x |

| UNIUSDT | 25x |

| BCHUSDT | 50x |

| LTCUSDT | 10x |

| XEMUSDT | 25x |

| SOLUSDT | 25x |

| LINKUSDT | 25x |

| MATI USDT | 25x |

| ETCUSDT | 25x |

| FILUUSDT | 25x |

| EOSUSDT | 50x |

| AAVEUSDT | 25x |

| XTZUSDTUSDT | 25x |

| SUSHIUSDT | 25x |

| Currepair | Maximum Leverage |

| BTC/USD | 100x |

| ETH/USD | 50x |

Transaction type

There are three types of bybit available: indefinite contracts, futures trading, and physical trading.

An indefinite contract indicates “FX”,which means a transaction without maturity or settlement.

- No maturity / settlement

- The transaction is almost the same as the index price

- Quick deposit and withdrawal

A futures contract, on the other hand, is about buying or selling a particular asset at a fixed price in the future at a fixed time and date.

The point is that the transaction has a deadline.

Security

Bybit is just a new exchange, and there are perfect security measures.

In addition to asset management with a cold wallet and two-step authentication, verification work at the time of deposit checks deposit records, transactions, and account balances (individuals / platforms) on all blockchains.

Therefore, even beginners can safely deposit their assets.

Event

There are always various event on bybit.

One of the most popular events is the luxurious bonus campaign.

You can get bonuses by depositing bybit, trading, introducing friends, etc.

You should actively take part in these events!

Comparison with other overseas exchanges

Once you understand the bybit fee, you might wonder if it’s cheap or not.

Here is a list of fees for overseas exchanges that offer derivative transactions.

Fees for Deribit and Bitfinex are the same as bybit.

For OKEx and BINANCE, the fee varies depending on the transaction volume and the amount of unique tokens held.

You can get more profit than with bybit, depending on how you use it.

| Exchange | transaction fees | Funding fees |

| bybit | maker: -0.025% Takker: 0.075% | ○ |

| BINANCE | maximum 0.1% | ○ |

| OKEx | maximum 0.15% | ○ |

| Deribit | maker: -0.025% Takker: 0.075% | ○ |

| MXC | fixed 0.2% | ○ |

Exchange Transaction Fee Funding Fee Summary of bybit fees

There are four types of fees charged by bybit: transaction fees, fund procurement, conversion fees, and settlement fees.

You can say that the amount is relatively low.

However, the funding rate also fluctuates from time to time, so it is important to have a good understanding of how they work.

However, it might be relatively easy to use the exchange, because it works just like bitMEX, such as the leverage with maximum 100 times and negative commission.

- There are four types of bybit fees: transaction fees, financing, conversion fees, and settlement fees.

- It basically works similar to bitMEX

- Transaction fees are low and you can receive commissions for limit orders

- Security measures are perfect because it is a new exchange

- You can enjoy cryptocurrency trading more thanks to events on a regular basis

Comment